capital gains tax rate 2021

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance

Gains from selling other assets are charged at.

. Because you only include onehalf of the capital gains from these properties in your taxable. Shares and similar investments Check if you are an investor or. 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work this.

The following Capital Gains Tax rates apply. Property and capital gains tax How CGT affects real estate including rental properties land improvements and your home. The rate of CGT is 33 for most gains.

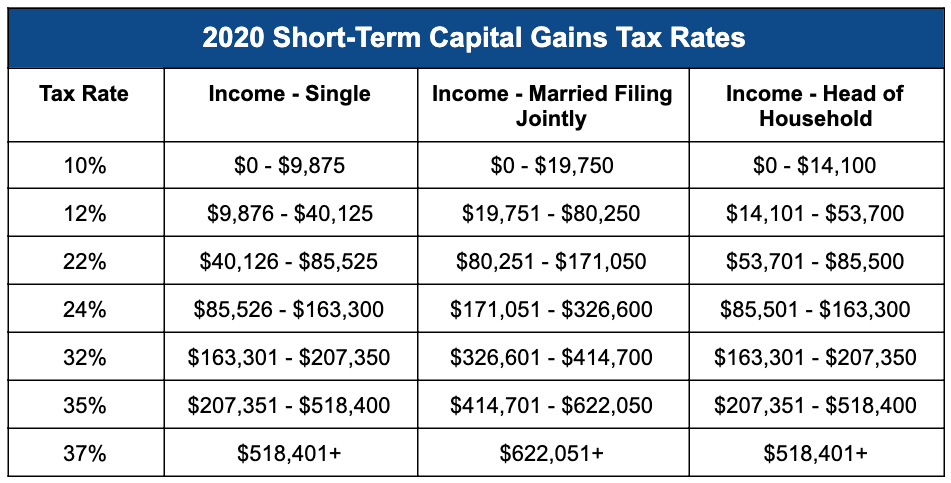

Events that trigger a disposal include a sale donation exchange loss death and emigration. 40 for gains from foreign life policies and foreign investment. Short-term capital gains are taxed at your ordinary income tax rate.

Pauls taxable income R 500 000 R 149 000 R 649 000. The tax rate on most net capital gain is no higher than 15 for most individuals. 4 rows Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for.

There are other rates for specific types of gains. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Pauls marginal rate of.

The capital gains tax rate that applies to profits from the sale of stocks mutual funds or other capital assets held for more than one year ie for long-term capital gains is either. If your taxable income is 47000 and youre filing as a single person youd pay tax at a rate of 15 on those gains making your long-term capital gains tax bill 1200. The standard rate of Capital Gains Tax is 33 of the chargeable gain you make.

This means youll pay 30 in Capital Gains. A rate of 40 can apply to the disposal of certain foreign life. Taxable capital gains that should be included in taxable income R 372 500 x 40 R 149 000.

2 rows In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above. Rate and payment of Capital Gains Tax. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for.

The following are some of the specific exclusions. There are two main categories for capital gains. Long-term capital gains are taxed at.

If your income was between 40000 and. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. 16 What are the applicable tax rates of Capital Gains Tax CGT under the National Internal Revenue Code of 1997 as amended by Republic Act No.

These rates are typically much lower than the ordinary income tax. If your income was between 0 and 40000.

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gains Tax Rates 2021 And How To Minimize Them Union Bank

Crypto Tax 2021 A Complete Us Guide Coindesk

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

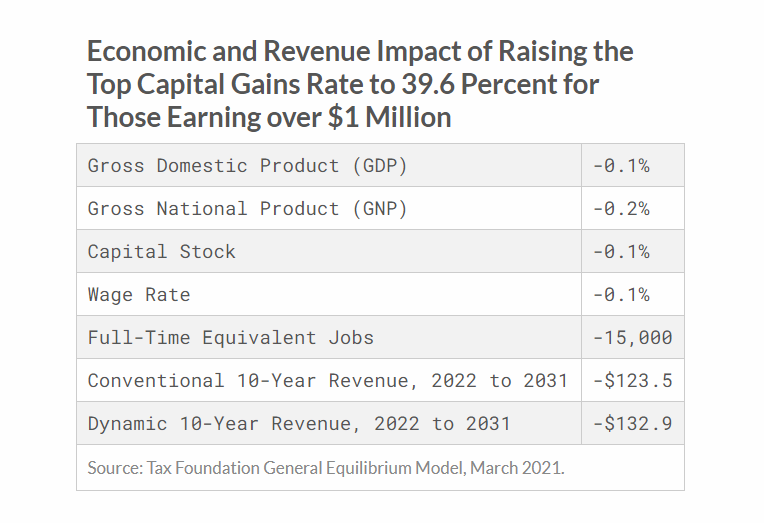

Tax Foundation On Twitter Raising The Top Capital Gains Tax Rate To 39 6 Percent For Those Earning Over 1 Million Would Reduce Federal Revenue By About 124 Billion Over 10 Years According

How Progressive Taxes Work In The United States Explained

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Crypto Capital Gains And Tax Rates 2022

2019 2021 Capital Gains Tax Rates Go Curry Cracker

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge